REFUND AND CANCELLATION POLICY

REFUND AND CANCELLATION POLICY

Solomon Associates

Effective Date: October 1, 2025

Last Updated: October 1, 2025

1. SCOPE OF POLICY

This Refund and Cancellation Policy applies to all professional services provided by Solomon Associates, including but not limited to

· Accounting and book keeping services

· Tax compliance and filing services

· Business incorporation

· Business consultation and advisory services

· Business auxiliary services

2. CANCELLATION POLICY

2.1 Before Service Commencement

· Full Refund Eligible: Services can be cancelled with 100% refund if cancellation request is made before we commence work on your project

· Notice Period: Written cancellation notice must be provided via email to mail@solomonassociates.in

· Processing Time: Cancellation requests will be processed within 48 hours of receipt

2.2 After Service Commencement

· Partial Refund: Cancellation after service commencement will be assessed on a case-by-case basis, subject to a maximum eligible refund of 60% of fee charged.

· Work Completed: Refund amount will be determined after deducting charges for work already completed and resources utilized

· Advance Notice: Minimum 3 business days advance written notice required for service cancellation, failing which implies work completed 3 days prior to intiamtion will be assessed and billed for considering refund.

2.3 Emergency Cancellations

In case of unforeseen circumstances or emergencies, we will make every effort to accommodate your needs and determine appropriate refund eligibility

3. REFUND POLICY

3.1 Eligible Circumstances

Refunds may be considered under the following circumstances:

· Service Not Rendered: When services cannot be delivered due to our inability to fulfill obligations

· Billing Errors: Overpayment or duplicate payment processing errors

· Quality Issues: Documented service quality concerns that cannot be resolved through remedial measures

· Force Majeure: Circumstances beyond reasonable control preventing service delivery

3.2 Non-Refundable Services

The following are generally non-refundable once delivered:

· Completed tax return filings and submissions to government portals

· Business incorporation certificates and legal documentation already processed

· Services where documentation and rendering are made-to-order

· Consultation services already provided (meetings, advice, guidance)

· Government fees, stamp duty, third-party charges and any other charges incurred

· Administrative processing fees for government applications

3.3 Time Limits for Refund Requests

· Request Window: All refund requests must be submitted within 3 days of service completion

· Documentation: Refund requests must be accompanied by written explanation and supporting documentation

· Processing Time: Valid refund requests will be processed within 3-7 business days

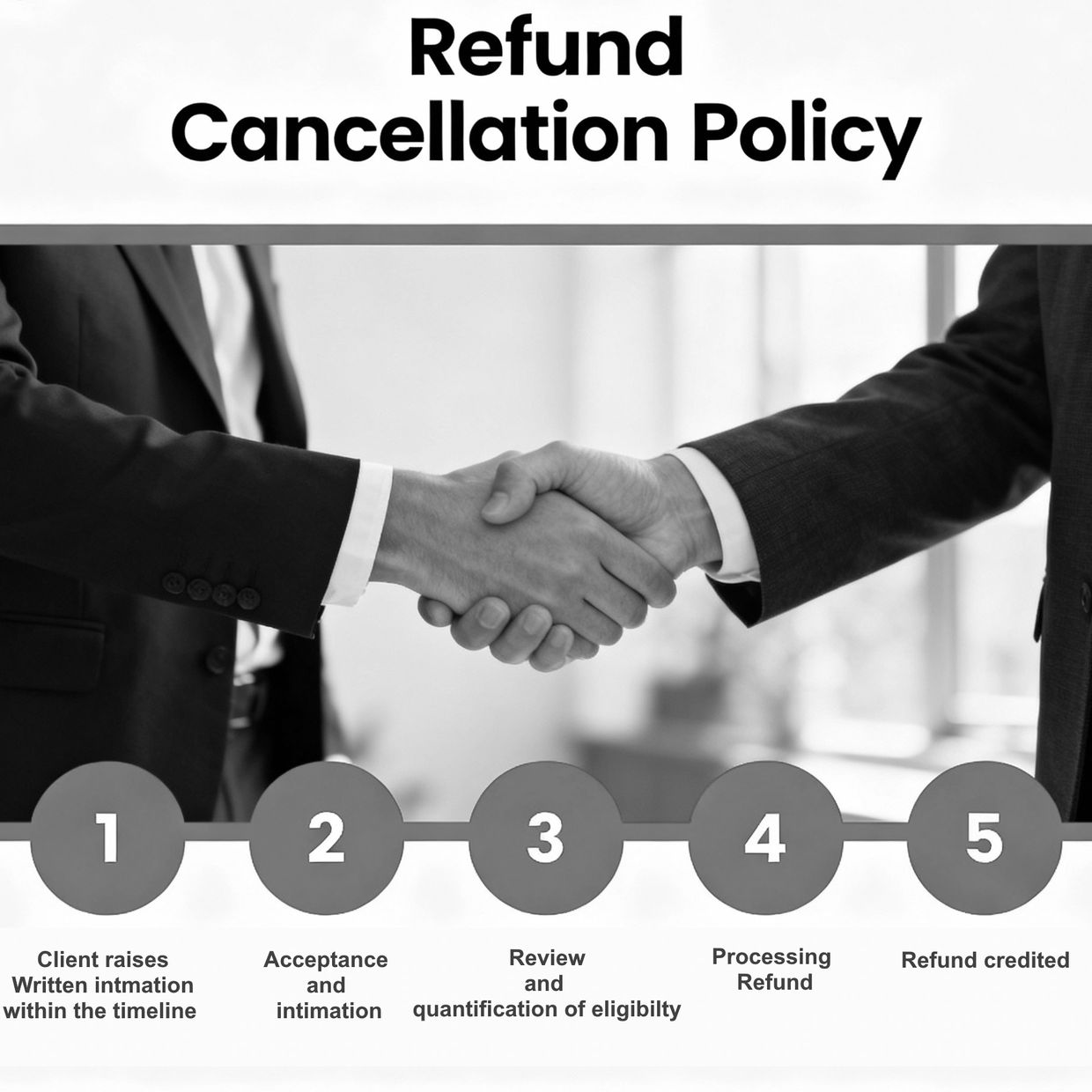

4. REFUND PROCESS

4.1 How to Request

· Submit written refund request to: mail@solomonassociates.in

· Include: Invoice number, service details, reason for refund, supporting documents

· Provide: Original payment method details for refund processing

4.2 Review and Processing

· All requests will be reviewed by our management team

· Refunds will be processed to the original payment method when possible

· UPI/digital payment refunds: 5-7 business days

· Bank transfer/cheque refunds: 10-15 business days

5. EXCEPTIONS AND SPECIAL CONDITIONS

The following exceptions will determine refund and cancellation eligiblity in special conditions

5.1 Government Compliance Services

· GST filing deadlines and statutory requirements may impact cancellation eligibility

· Time-sensitive compliance services may have restricted cancellation windows

· Late cancellation may result in penalty charges if statutory deadlines are missed

5.2 Package Services

· Multi-service packages will be evaluated proportionally based on services completed

· Bundled service discounts may be recalculated for partial cancellations

6. DISPUTE RESOLUTION

6.1 Internal Resolution

· Initial concerns should be addressed directly with your assigned consultant

· Escalation to management team if not resolved within 48 hours

· Good faith effort to reach mutually acceptable solution

6.2 Legal Framework

· This policy is governed by the Consumer Protection Act, 2019

· Compliance with E-commerce Rules, 2020 for digital transactions

· Disputes subject to jurisdiction of courts in Kollam, Kerala, India

7. CONTACT INFORMATION

For all refund and cancellation related queries:

Email: info@solomonassociates.in

Address: Solomon Associates, Kollam, Kerala, India

Website: www.solomonassociates.in

8. MAXIMUM REFUND LIABILITY LIMITATION

"Under no circumstances shall Solomon Associates be liable to refund any amount exceeding one hundred percent (100%) of the total fees actually paid by the client for the specific service(s) in question. The maximum aggregate liability of Solomon Associates for any refund claim, whether arising from breach of contract, negligence, or any other cause of action, shall be strictly limited to the total amount of consideration received from the client for the particular service engagement that is the subject of the refund request."

9. POLICY MODIFICATIONS

· Solomon Associates reserves the right to modify this policy at any time

· Changes will be posted on our website with updated effective date

· Continued engagement constitutes acceptance of policy updates

· Existing service agreements will be governed by the policy in effect at the time of engagement

Note: This policy is designed to ensure fairness and transparency while complying with Indian consumer protection laws. For specific situations not covered in this policy, please contact us directly for personalized assistance.